Complaints – They Drive the CFPB to Your Doorstep

The CFPB uses a number of different factors to determine who should be investigated. The factors are listed below in order of priority or frequency of investigative occurrence:

- Entries into the CFPB’s consumer complaint database and the type of entry. The more entries (regardless of outstanding balance volume) and the severity of the complaints will drive the CFPB to your doorstep.

- CFPB investigations of one of your clients or vendors. During the CFPB’s CID process they will ask for and receive a list of all of the clients and vendors. You could be one of them. Be careful who you develop relationships with.

- AG or other regulatory complaints. All governmental bodies communicate with each other.

Complaints put you in the CFPB’s crosshairs, leading to regulatory exposure, inquiries, examinations, supervision, consent orders, and enforcement actions.

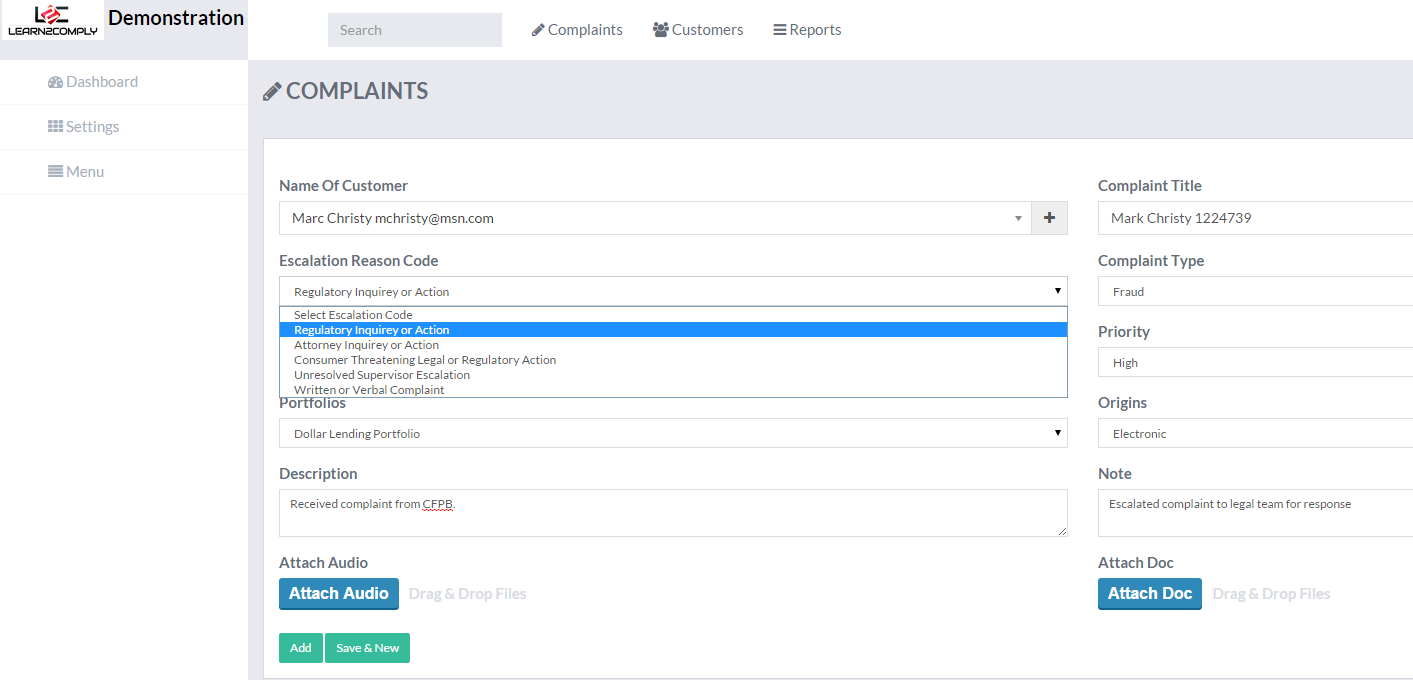

learn2comply delivers the most comprehensive complaint management system in the financial services industry.

Online Complaint Management System Solution